Loading

Get Form Ma Nrcr - Mass

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form MA NRCR - Mass online

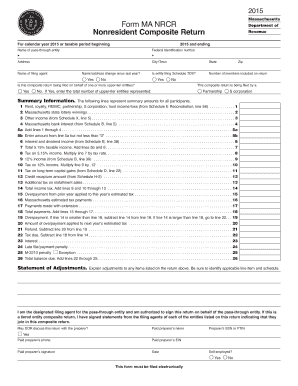

This guide provides a detailed walkthrough for users looking to fill out the Form MA NRCR, which is the Nonresident Composite Return for Massachusetts. Whether you are filing on behalf of an entity or as an individual, this step-by-step approach ensures you understand each section of the form, facilitating a smooth filing experience.

Follow the steps to complete the form online effectively.

- Click ‘Get Form’ button to access the form and open it in the document editor, allowing you to begin filling out the required fields.

- Enter your federal identification number in the designated field to ensure accurate processing of your return.

- Fill in your current address, city or town, state, and zip code. If there has been a name or address change since the last year, select 'Yes' or 'No' as applicable.

- Indicate whether the entity is filing Schedule TDS by selecting 'Yes' or 'No' based on your circumstances.

- Provide the number of members included in the return and indicate if this composite return is being filed on behalf of any upper-tier entities by selecting 'Yes' or 'No'.

- Add details regarding the name of the pass-through entity and the name of the filing agent responsible for this return.

- Complete the Summary Information section, being sure to accurately enter income and other financial details from relevant schedules.

- Calculate the total income tax by adding the required lines from the summary section, ensuring that your calculations align with Massachusetts tax regulations.

- Review any overpayments or estimated tax payments made, if applicable, and enter these amounts in the appropriate fields.

- Identify and enter any penalties, interest, or late fees that may apply, ensuring you adhere to all filing guidelines.

- In the Statement of Adjustments, explain any necessary adjustments related to the items listed on the return to clarify your filing.

- Confirm your authorization by ticking the appropriate boxes and completing the signature fields for the designated filing agent.

- Double-check all entered information for accuracy, then save your changes. You can now download, print, or share the form as needed.

Get started with your online filing by completing the Form MA NRCR today!

Related links form

You may need the following: Copies of last year's federal and state tax returns. Personal information including: ... Records of your earnings (W-2 forms from each employer or 1099-MISC forms if you're a contractor) Records of interest and dividends from banks (1099 forms: 1099-INT, 1099-DIV, etc.)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.