Loading

Get Old Age Security Return Of Income 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Old Age Security Return Of Income 2016 online

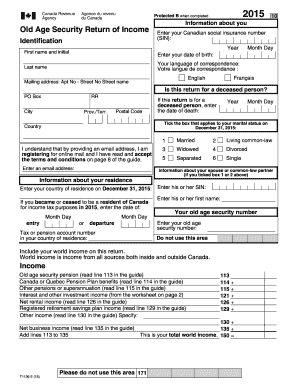

Filing the Old Age Security Return of Income is essential for ensuring accurate assessment of benefits. This guide provides a clear and user-friendly approach to completing the form online, ensuring that users understand each component involved in the process.

Follow the steps to complete your return online.

- Click ‘Get Form’ button to access the Old Age Security Return of Income 2016 form and open it in your preferred editor.

- Enter your Canadian social insurance number (SIN) in the designated field to uniquely identify yourself.

- Provide your first name, last name, and date of birth. Ensure that the date is formatted correctly with the month, day, and year.

- Indicate your language of correspondence by selecting either English or Français.

- Fill in your mailing address, including apartment number, street, city, province or territory, and postal code.

- If applicable, indicate whether this return is for a deceased person by ticking the relevant box and provide the date of death.

- Select your marital status as of December 31, 2015, by ticking the appropriate box.

- If you have a spouse or common-law partner, enter their information including SIN, first name, and any other required details.

- Next, provide your old age security number in the specified field.

- List your total world income, including old age security pension, Canada or Quebec Pension Plan benefits, and any additional income sources as specified on the form.

- Calculate your deductions, including any carrying charges and interest expenses, and summarize this information appropriately.

- Compute your net world income, and subsequently, determine your refund or balance owing based on the calculations provided on the form.

- Sign and date the return, certifying that the information provided is correct and complete.

- Save any changes made to the form, and utilize the option to download, print, or share the completed document as necessary.

Complete your documents online for efficient management and submission.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

As a rule, you can deduct a business investment loss on line 234 if you sustained losses in 2022 on investments (shares or debt securities) in a Canadian-controlled private corporation (that is, a corporation whose shares are not listed on a stock exchange).

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.