Loading

Get (supplementary Section) - Ato Gov

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the supplementary section - Ato Gov online

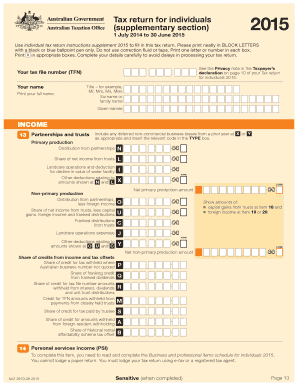

Navigating the supplementary section of your tax return online can seem overwhelming, but careful attention to detail can simplify the process. This guide aims to provide clear, step-by-step instructions to help you accurately complete the necessary fields and ensure that your tax return is processed efficiently.

Follow the steps to fill out the supplementary section easily.

- Press the ‘Get Form’ button to access the form online and open it in your editor.

- Begin by entering your tax file number (TFN) in the appropriate box to identify your tax records.

- Fill in your personal details, including your title (e.g., Mr, Mrs, Ms), surname, and given names. Ensure that you print neatly in block letters.

- In the income section, identify and record any relevant income from partnerships and trusts, including deferred non-commercial business losses.

- Complete each income entry accurately, marking each relevant box correctly, such as 'X' or other designated indicators, ensuring totals are calculated as instructed.

- Proceed to the deductions section, where you will list deductible amounts like personal contributions to superannuation. Clearly label and enter the amounts.

- For tax offsets, add up all applicable items, ensuring to stop at any fields relevant to your personal situation, and guidance is followed as per the instructions.

- Make sure to review your entries for errors or omissions, cross-referencing with the guidelines provided in the supplementary instructions.

- Once completed, save your changes, and confirm that you are ready for submission.

- Finally, ensure that you attach this supplementary section to your main tax return and sign the taxpayer's declaration.

Complete your tax return online to ensure a smooth filing process.

Attach your supplementary section to page 10 of your tax return. For more information, read the Checklist and the subsequent pages in Individual tax return instructions 2022.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.