Loading

Get Instructions Direct Shipper Quarterly Statement - Oregon

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the INSTRUCTIONS DIRECT SHIPPER QUARTERLY STATEMENT - Oregon online

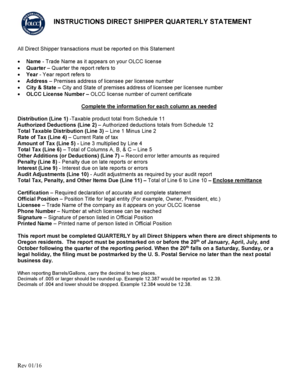

Filling out the Instructions Direct Shipper Quarterly Statement for Oregon is essential for reporting tax obligations on direct shipments. This comprehensive guide provides clear and concise guidance to assist you in accurately completing the form online.

Follow the steps to successfully complete your statement online.

- Press the ‘Get Form’ button to access the form and open it in your preferred editing tool.

- Enter your trade name as it appears on your OLCC license in the designated field.

- Indicate the quarter your report pertains to by selecting the appropriate check box: January-March, April-June, July-September, or October-December.

- Fill in the year corresponding to the reporting period you are completing.

- Provide the premises address as listed on your OLCC license, ensuring all details are accurate.

- Record the city and state of the premises address as per your license.

- Input your OLCC license number in the specified field.

- Complete Line 1 by entering the total amount of taxable product shipped to Oregon residents from Schedule 11.

- On Line 2, include the totals for any authorized deductions based on Schedule 12.

- Calculate Line 3 by subtracting Line 2 from Line 1 to find the total taxable distribution.

- Indicate the current rate of tax applicable for your reporting period in Line 4.

- Multiply the amount on Line 3 by the rate of tax on Line 4 to determine the amount of tax, and enter it on Line 5.

- Summarize the total tax for all columns (A, B, & C) as designated in Line 6.

- Complete Line 7 with any other additions or deductions as required.

- Record penalties due on late reports or errors in Line 8.

- On Line 9, enter interest due on late reports or errors, calculated at 1% per month.

- Input any audit adjustments as required by your audit report in Line 10.

- Calculate Line 11, which totals lines 6 through 10, and ensure to enclose the remittance.

- Complete the certification statement and sign where indicated, also providing your printed name and official position.

- Finally, ensure all information is correct before saving changes, downloading, printing, or sharing your completed form.

Submit your completed form online to ensure timely processing of your taxes.

INSTRUCTIONS PRIVILEGE TAX SCHEDULE 4 All Malt and Wine Products shipped outside of Oregon must be reported on this schedule, including consignment merchandise. The credit is only allowed on Product that the State tax has been paid.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.