Loading

Get Number 20123401f - Irs

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Number 20123401F - Irs online

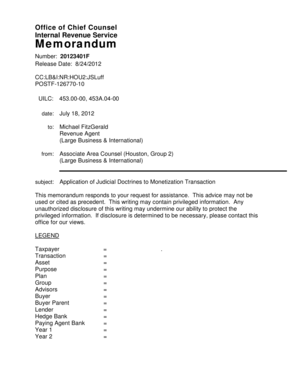

The Number 20123401F - Irs is an important document that deals with the application of judicial doctrines to monetization transactions. This guide provides detailed instructions on filling out this form online, ensuring you can navigate the process with confidence.

Follow the steps to fill out the Number 20123401F - Irs online effectively.

- Click the ‘Get Form’ button to obtain the form and open it in the editor. This will allow you to access the interactive version of the form where you can fill in the required information.

- Begin by entering the taxpayer's information in the designated fields. Ensure that all personal and business details are accurate and up-to-date.

- Proceed to fill out the transaction details. Be meticulous when entering descriptions of the asset, transaction dates, and financial amounts associated with the monetization transaction.

- Address the fields related to judicial doctrines, specifically the substance over form doctrine and the step transaction doctrine. Provide relevant context based on your understanding of your transaction.

- Review the completed form for accuracy. Double-check that all entries are correct and align with the information provided in your transaction documentation.

- Once satisfied with the form, save your changes. You can then download, print, or share the completed form as needed.

Take the next step in your document management by completing the Number 20123401F - Irs online today.

Related links form

Stocks, bonds, other securities, inventory, or property a dealer sells cannot be sold using the installment sales method. Two of the payments will be made in the year you sold it, and two will be made the next year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.