Loading

Get - Ct

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT-EITC online

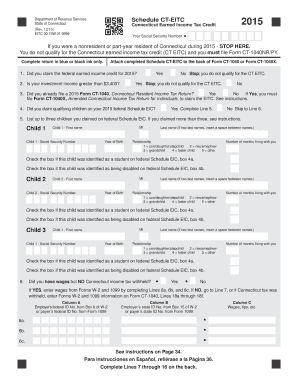

This guide provides comprehensive instructions on how to fill out the Schedule CT-EITC form for the Connecticut Earned Income Tax Credit. Whether you are familiar with tax documents or new to this process, this guide will assist you step-by-step.

Follow the steps to fill out the Schedule CT-EITC form effectively.

- Click ‘Get Form’ button to obtain the form and open it in your editor.

- Begin by indicating whether you claimed the federal earned income credit for the year in question. Answer 'Yes' or 'No' as applicable. If you answer 'Yes' to having investment income greater than $3,400, then you do not qualify for the CT EITC.

- Confirm if you have already filed a 2015 Form CT-1040. Answer 'Yes' or 'No'. If 'Yes', you will need to file Form CT-1040X to claim the EITC.

- Evaluate whether you claimed qualifying children on your federal Schedule EIC. Answer 'Yes' or 'No'. If 'Yes', proceed to fill out Line 5 by listing your qualifying children; if 'No', go to Line 6.

- For each child, provide their first name, middle initial, last name, Social Security Number, year of birth, relationship to you, number of months living with you, and check applicable boxes for student status or disability.

- Indicate whether you had wages but no Connecticut income tax withheld by selecting 'Yes' or 'No'. If 'Yes', enter your wages from Forms W-2 and 1099 as instructed.

- If you were self-employed or had income not reported on a W-2 or 1099, confirm this by answering 'Yes' or 'No'. If 'Yes', complete the required lines with the appropriate income information.

- Report the amount of federal earned income credit claimed. This figure will be used to calculate your Connecticut EITC.

- Complete the Connecticut EITC calculation lines according to the instructions, ensuring to multiply required lines accurately.

- Lastly, review all the information entered. You can save your changes, download, print, or share the form as necessary.

Complete your Schedule CT-EITC online for an easy and hassle-free tax credit application.

Computed Tomography (CT) Scans and Cancer.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.