Loading

Get Fillable Form I 338

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fillable Form I-338 online

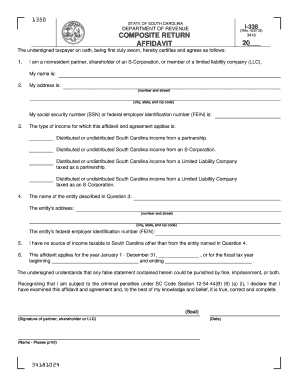

Filling out the Fillable Form I-338 online can streamline the process of certifying your nonresident tax obligations. This guide provides step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the Fillable Form I-338.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Provide your name in the designated field to identify yourself as the taxpayer.

- Fill in your address in the specified section, including number, street, city, state, and zip code.

- Input your social security number (SSN) or federal employer identification number (FEIN) in the corresponding field.

- Select the type of income applicable to your affidavit from the provided options.

- Enter the name and address of the entity you are affiliated with, along with its FEIN.

- State that you have no other sources of taxable income in South Carolina besides the stated entity.

- Complete the year for which this affidavit applies or specify the fiscal year details.

- Sign and date the affidavit in the designated area.

- After completing the form, save your changes, and download a copy for your records.

Ensure your tax obligations are met by filling out the required documents online today.

I-338 COMPOSITE RETURN AFFIDAVIT INSTRUCTIONS The composite return includes income received by the participant from the partnership, S-Corporation or LLC. Each participant's tax is computed separately and added together to arrive at the total tax due on the composite return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.