Loading

Get Form 80-105 - Dor Ms

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 80-105 - Dor Ms online

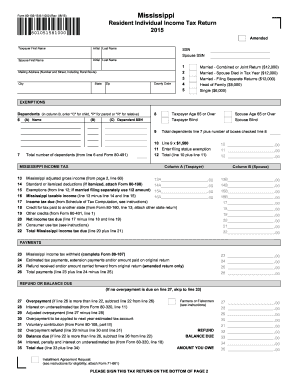

Filing a tax return can seem daunting, but understanding each component of Form 80-105 - Dor Ms will simplify the process. This guide provides a clear breakdown to help users complete the form accurately and efficiently online.

Follow the steps to fill out Form 80-105 - Dor Ms online.

- Press the ‘Get Form’ button to obtain the form and open it in the designated editor.

- Enter your personal information in the taxpayer section, including first name, initial, last name, and your Social Security Number (SSN). If applicable, fill in your spouse's details similarly.

- Complete the mailing address section with your number and street, city, state, and zip code.

- Indicate your filing status by selecting the appropriate option from the provided choices reflecting your situation (e.g., married filing jointly, head of family, single).

- Provide information about dependents in the exemptions section. For each dependent, enter their name, relationship, and SSN as applicable.

- Fill in your total number of dependents and check any boxes for taxpayer age or blindness to claim further exemptions.

- Calculate your Mississippi income tax by providing adjusted gross income, deductions, exemptions, and tax credits as specified in the form.

- Review and summarize payments, refunds, or balances due in the appropriate sections of the form to finalize your calculations.

- Once all fields are accurately filled, save your changes. You can also choose options to download, print, or share the form as needed.

Complete your documents online today to ensure timely and accurate submissions.

Related links form

State Tax Forms Department of Revenue - State Tax Forms. Living. Forms. Arrow Website. https://.dor.ms.gov/individual/individual-income-tax-forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.