Loading

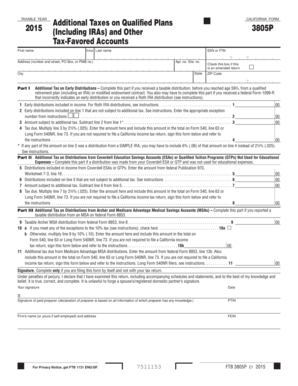

Get 2015 Form 3805p -- Additional Taxes On Qualified Plans Including - Ftb Ca

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2015 Form 3805P -- Additional Taxes On Qualified Plans Including - Ftb Ca online

Filling out the 2015 Form 3805P is essential for reporting additional taxes on qualified plans, such as IRAs and other tax-favored accounts. This guide provides clear instructions to help users complete the form accurately and efficiently in an online environment.

Follow the steps to fill out the 2015 Form 3805P online.

- Click ‘Get Form’ button to access the form and open it in your preferred online editor.

- Enter your first name and initial last name in the designated fields.

- Provide your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) in the respective field.

- Fill in your address, including the number and street, PO Box, or PMB number, as well as the apartment or suite number if applicable.

- Complete the city and state fields, followed by the ZIP code.

- If you are amending a return, check the box indicating this is an amended return.

- Proceed to Part I to report any early distributions. Enter the total early distributions included in your income on line 1.

- On line 2, enter the amount of early distributions that are not subject to additional tax, based on the exceptions outlined in the instructions.

- Calculate the amount subject to additional tax by subtracting line 2 from line 1 and enter this total on line 3.

- Multiply the amount on line 3 by 2½% (.025) to determine the tax due, and enter this figure on line 4.

- For distributions from Coverdell ESAs or Qualified Tuition Programs, complete Part II by entering the applicable amounts following the same format as above.

- For distributions from Archer or Medicare Advantage MSAs, complete Part III by reporting the taxable distributions using lines 9 to 11 as outlined.

- Once all sections are complete, review the form for accuracy and make sure to sign and date the document if filing it by itself.

- Finally, save your changes, download the form, and print or share it as needed for your records.

Complete your online forms efficiently and accurately by following this guide.

Use form FTB 3805P, Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts, to report any additional tax you may owe on an early distribution from an individual retirement account (IRA), other qualified retirement plan, annuity, modified endowment contract, or medical savings account (MSA).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.