Loading

Get Dor 82514b - Azdor

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DOR 82514B - Azdor online

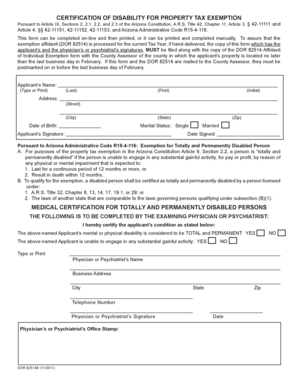

Filling out the DOR 82514B - Azdor form is an essential process for individuals applying for a property tax exemption due to total and permanent disability. This guide will walk you through each component of the form, ensuring a smooth and efficient online completion.

Follow the steps to successfully complete the DOR 82514B - Azdor online.

- Click ‘Get Form’ button to access the DOR 82514B - Azdor form and open it in your preferred format for editing.

- Provide your name in the designated fields. Ensure to fill in your last name, first name, and middle initial accurately. This information is crucial for your application.

- Fill in your address, including street, city, state, and zip code, accurately. It is important that this information matches your official identification.

- Input your date of birth in the designated section. Be sure to use the correct format to avoid any processing issues.

- In the marital status section, indicate whether you are single or married by selecting the appropriate option.

- Sign the application where indicated, confirming that the information you have provided is true and accurate.

- Have your examining physician or psychiatrist complete the medical certification section. They will need to confirm your disability and certify that you are totally and permanently disabled.

- After filling out the entire form, review it for accuracy. Make any necessary corrections before proceeding.

- Once you are satisfied with your form, you can save your changes, download a copy, print it for your records, or share it as needed.

Complete your DOR 82514B - Azdor form online today to ensure your property tax exemption is processed efficiently.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Arizona provides property tax exemptions, in varying dollar amounts, to qualifying disabled persons and widows/widowers, whose spouses passed away while residing in Arizona. Anyone with questions regarding deadlines and criteria for property tax exemptions may phone contact the Assessor's Office.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.