Loading

Get 2015 Form 3805q -- Net Operating Loss Nol Computation And - Ftb Ca

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2015 Form 3805Q -- Net Operating Loss NOL Computation And - Ftb Ca online

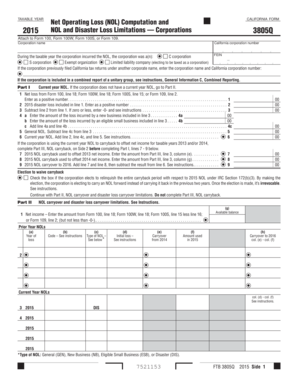

Filling out the 2015 Form 3805Q for net operating loss computation is a crucial step for corporations navigating tax deductions in California. This guide will provide clear, step-by-step instructions to assist users in completing the form accurately online.

Follow the steps to fill out the form effectively.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editing tool.

- Enter the corporation name, California corporation number, and FEIN in the appropriate fields at the top of the form. Ensure all information is accurate before proceeding.

- Indicate the type of corporation by checking the appropriate box (C corporation, S corporation, exempt organization, or limited liability company). If applicable, provide the previous corporate name and number.

- Move to Part I, where you will calculate the current year NOL. First, enter the net loss from the required form line (Form 100, line 18; Form 100W, line 18; etc.) as a positive number on line 1.

- If you have a disaster loss included in line 1, enter that amount on line 2. Then, subtract line 2 from line 1 and record the result on line 3.

- For lines 4a and 4b, enter any losses incurred by a new business or an eligible small business, respectively. Add these amounts for line 4c.

- Complete line 5 by subtracting line 4c from line 3 to determine the general NOL. Add line 2, line 4c, and line 5 for line 6 to summarize the current year NOL.

- If you are utilizing a carryback for the current year NOL, fill in lines 7 and 8 with applicable amounts from Part III before proceeding to Part II.

- In Part II, begin with the net income from the applicable form line. Document any available balances and carryovers accordingly in the tables provided.

- Continue with Part III if applicable, documenting carrybacks used for previous taxable years.

- Finally, review all entries for accuracy and completeness. Save your changes, download, print, or share the completed form as needed.

Complete your documentation online now for a smooth filing process!

Related links form

Your California NOL is generally calculated the same as the Federal. However, allowable amounts and the carryback/carryforward periods differ between Federal and California. Visit Instructions for Form FTB 3805V or Instructions for Form FTB 3805Q for more information.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.