Loading

Get Form It-237-i - Department Of Taxation And Finance - New York State - Tax Ny

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Form IT-237-I - Department Of Taxation And Finance - New York State - Tax Ny online

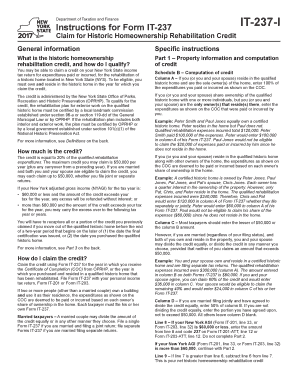

This guide is designed to help users navigate the process of filling out Form IT-237-I for the Historic Homeownership Rehabilitation Credit with ease. By following these step-by-step instructions, individuals can ensure accurate completion and submission of their tax information.

Follow the steps to properly complete Form IT-237-I online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Provide your personal information as required on the form. This typically includes your name, address, and social security number.

- Complete Part 1 by entering property information and computing the credit. Ensure you have the Certificate of Completion details handy for this section.

- In Part 1, review the qualifications for claiming the credit to confirm eligibility. You must reside in the historic home for which you claim the credit.

- Fill out Schedule B - Computation of credit. Enter the expenditures from the Certificate of Completion in the appropriate columns, ensuring accuracy in splitting expenditures if multiple owners exist.

- Calculate your potential credit based on the instructions provided in the form. This may involve referencing income limits and applicable credit calculations.

- Proceed to Part 2 if your adjusted gross income exceeds the threshold for direct credit application. Calculate any carryover if applicable.

- Complete Part 3 if necessary, particularly if recapturing previously claimed credits due to changes in residence.

- Review your entries for accuracy and completeness. Ensure you have filled out all relevant sections pertaining to your situation.

- Once satisfied with your form, save your changes. You can download, print, or share the form as needed for your records or submission.

Start filling out your Form IT-237-I online today to take advantage of the Historic Homeownership Rehabilitation Credit!

Related links form

You can get the full education tax credit if your modified adjusted gross income, or MAGI, was $80,000 or less in 2022 ($160,000 or less if you file your taxes jointly with a spouse). If your MAGI was between $80,000 and $90,000 ($160,000 and $180,000 for joint filers), you'll receive a reduced credit.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.