Loading

Get Property Tax Exemption Application For Organizations 70941018 Pt ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Property Tax Exemption Application For Organizations 70941018 Pt ... online

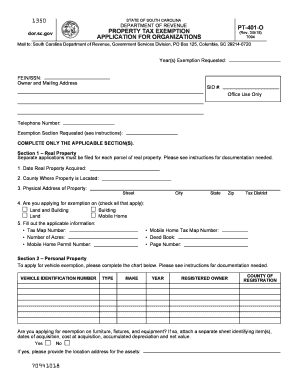

Completing the Property Tax Exemption Application For Organizations can seem daunting, but with the right guidance, the process can be straightforward. This guide provides a step-by-step approach to filling out the application form online, ensuring you provide all necessary information accurately.

Follow the steps to effectively complete the application online.

- Click ‘Get Form’ button to access the application form and open it in your preferred PDF editor.

- Enter the year(s) for which you are requesting the exemption, and include your FEIN or SSN at the designated section.

- Fill in the owner and mailing address. Make sure this information is current and accurate.

- Locate the exemption section that pertains to your application, then complete only the applicable section(s) for real property or personal property as needed.

- For real property, provide the date the property was acquired, the county where it is located, and the physical address. Select all applicable types of property you are claiming exemption for (land, building, mobile home).

- Fill in the specific details regarding the property such as tax map number, number of acres, and, if applicable, mobile home permit and tax map numbers.

- If applying for personal property exemptions, complete the vehicle chart, entering the vehicle identification number, type, make, year, registered owner, and county of registration.

- Indicate whether you are applying for exemption on furniture, fixtures, and equipment. If so, provide a separate sheet detailing the items, including acquisition dates and value.

- Answer the real property exemption questions fully, including explanations of property use and any rent received.

- In the declaration section, confirm and sign with your date to validate the application. Ensure everything provided is true to the best of your knowledge.

- After reviewing for accuracy, save changes to the form. You can download, print, or share the completed application as required.

Start filling out your Property Tax Exemption Application online today to ensure you secure the exemptions you are entitled to.

Veterans with 100% disability, or partially disabled and unemployable, or their unmarried surviving spouses, are eligible for up to a $161,083 exemption. If total household income does not exceed $72,335, the 100% disabled veteran may qualify for up to a $241,627 exemption.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.