Loading

Get Ar1050 2015 - Dfa Arkansas

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the AR1050 2015 - Dfa Arkansas online

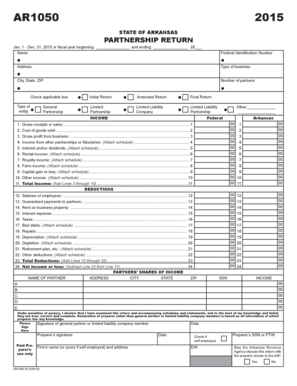

The AR1050 2015 - Dfa Arkansas is a partnership return form used by partnerships to report their income, deductions, and partner information for the fiscal year. This guide provides clear, step-by-step instructions on how to complete the form online, ensuring that users can file correctly and efficiently.

Follow the steps to fill out the AR1050 2015 - Dfa Arkansas comprehensively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the partnership name at the top of the form. Ensure that it matches the official business registration.

- Provide the federal identification number associated with the partnership. This number is crucial for tax reporting.

- Fill in the partnership's address, including city, state, and ZIP code. Make sure this information is current.

- Indicate the type of business by checking the applicable box and specifying the type of entity (general partnership, limited partnership, etc.).

- Enter the number of partners involved in the partnership in the designated field.

- Proceed to the income section where you will input the gross receipts or sales amount, followed by the cost of goods sold. Calculate the gross profit by subtracting cost of goods sold from gross receipts.

- Continue detailing income from various sources such as other partnerships, interest, rental, royalty, and any capital gains. Attach any necessary schedules as required.

- Navigate to the deductions section and list all applicable expenses including salaries, guaranteed payments, and other business-related costs. Don’t forget to attach supporting schedules where necessary.

- Calculate the total income and total deductions, then derive the net income or loss by subtracting the total deductions from total income.

- Lastly, detail each partner’s share of income using the provided sections. Ensure that the information is accurate and complete.

- Once all sections are filled out and reviewed, save your changes. You have the option to download, print, or share the completed form as needed.

Complete your AR1050 2015 - Dfa Arkansas online today for a hassle-free filing experience.

State Income Tax Filing Requirements To claim any refund due, you must file an Arkansas income tax return. Residents of Ar- kansas must complete Form AR1000. Nonresidents and Part-Year Residents must complete Form AR1000NR.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.