Loading

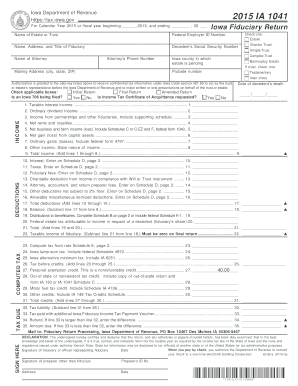

Get For Calendar Year 2015 Or Fiscal Year Beginning ,2015, And Ending , 20

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the For Calendar Year 2015 Or Fiscal Year Beginning, 2015, And Ending, 20 online

This guide provides straightforward instructions on completing the For Calendar Year 2015 or Fiscal Year Beginning, 2015, and Ending, 20 form. It aims to assist users in navigating the online filing process with clarity and confidence.

Follow the steps to successfully fill out the form online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Begin by selecting the type of fiduciary return you are filing—Estate, Grantor Trust, Simple Trust, or Complex Trust. Specify the name of the estate or trust, and provide the Federal Employer Identification Number.

- Fill in your name, address, and title as the fiduciary, along with the decedent’s Social Security Number and attorney's details.

- Indicate the Iowa county where the estate is pending. If applicable, mark the appropriate checkboxes for the type of return being filed (Initial, Final, Amended).

- Provide the date of the decedent’s death and enter all relevant income sources in the Income section. Ensure to include supporting schedules for items like partnership income and business earnings.

- In the Deductions section, list all deductions, including fiduciary fees and charitable contributions. Total deductions should be calculated accurately.

- Proceed to calculate your taxable income by subtracting your total deductions from total income. Enter this value into the appropriate field.

- Compute the tax using the provided tax rates from Schedule E. Make sure to include any additional taxes and credits applicable to your situation.

- Finally, review the form for accuracy. Save any changes made, and prepare the documentation for submission. You can download, print, or share the completed form as needed.

Complete your forms online today for a streamlined filing experience.

In the UK, it's also known as the “tax year” and it runs from 6th April one year to 5th April the following year. Each tax year is described as 2023/24 tax year, for example, rather than the “tax year 2023” or “fiscal year 2024”.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.