Loading

Get Form 5119

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 5119 online

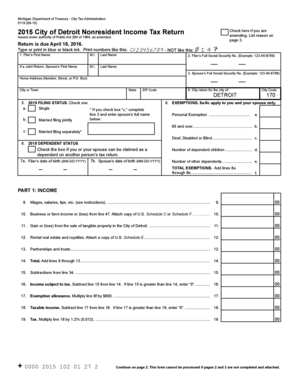

Filling out Form 5119 is essential for reporting nonresident income tax for the city of Detroit. This guide provides clear and user-friendly steps to assist you in completing the form online, ensuring your filing process is efficient and accurate.

Follow the steps to complete Form 5119 online effectively.

- Click 'Get Form' button to access the online version of Form 5119 and open it in your preferred editor.

- Begin with section 1, where you will enter the filer's first and last name, along with the middle initial if applicable. If filing a joint return, include your partner's details as well.

- Provide the Social Security numbers for both the filer and the spouse if filing jointly, ensuring you format it as '123-45-6789'.

- Fill in the home address, including house number, street, city, state, and ZIP code.

- Indicate your filing status by checking one of the boxes for single or married filing jointly. If married filing jointly, enter your spouse's full name.

- In section 8, check the applicable exemptions for you and your spouse, particularly if either of you is 65 or older, or if you are deaf, disabled, or blind.

- Enter the dates of birth for both the filer and spouse in the format MM-DD-YYYY.

- In Part 1, record income details starting with business income, wages, rental income, and any partnership or trusts income. Ensure all figures are clearly documented.

- Calculate total payments and credits in Part 2. This includes tax withheld and any estimated payments, which will help determine your overall tax balance.

- In Part 3, assess whether you owe taxes or are due a refund by comparing total payments to taxable income.

- Complete Parts 4 through 7 regarding subtractions from income, ensuring all amounts are positive, and provide necessary certifications.

- Once all sections are filled out, review the form for accuracy. Save, download, print, or share the completed form as needed.

Complete your Form 5119 online today to ensure timely processing and compliance.

Nonresident aliens will use Form 1040-NR to file their returns instead of Form 1040, which U.S. citizens and resident aliens use. A nonresident who later becomes a resident alien in the same year (known as a dual status alien) will need to file a 1040 with a 1040-NR attachment.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.