Loading

Get Please Complete A Separate Profit Aand Loss Statement For Each Business Owned By The Borrowers Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Please Complete A Separate Profit And Loss Statement For Each Business Owned By The Borrowers Form online

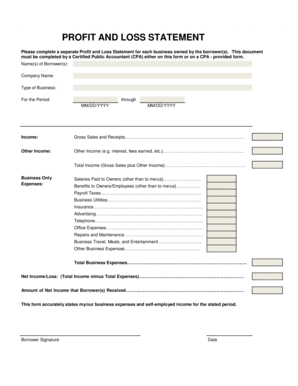

This guide provides step-by-step instructions on how to fill out the Please Complete A Separate Profit And Loss Statement For Each Business Owned By The Borrowers Form online. Whether you are a business owner seeking financing or managing your financial records, this form is essential to accurately report your business income and expenses.

Follow the steps to accurately complete your profit and loss statement.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the name(s) of the borrower(s) in the designated field at the top of the form.

- Enter your company's name in the specified section below the borrowers’ names.

- Indicate the type of business you operate by selecting the appropriate option from the dropdown or entering it manually.

- Specify the period for which you are reporting by filling in the start and end dates in the format MM/DD/YYYY.

- Report your income by filling in the gross sales and receipts in the provided space.

- Document any other income you have received, such as interest or fees earned, in the designated field.

- Calculate the total income by adding the gross sales to any other income and input this total in the specified spot.

- Move on to the expenses section and list salaries paid to owners (not including yourself).

- Provide details on benefits offered to owners and employees, excluding yourself.

- Fill in the payroll taxes, business utilities, insurance, advertising, telephone expenses, office expenses, repairs and maintenance, and any business travel, meals, and entertainment costs.

- Add any other business expenses into the 'Other Business Expenses' field.

- Sum up all the business expenses and enter the total in the corresponding area.

- Calculate the net income or loss by subtracting the total expenses from the total income and enter this value.

- Finally, indicate the amount of net income that was received by the borrower(s) in the provided section.

- Complete the form by signing and dating it in the designated area, certifying the accuracy of the information provided.

- Once all fields are filled out, ensure to save your changes, download, print, or share the form as needed.

Get started on completing your profit and loss statement online today!

The self-employed income analysis (form 1084A or 1084B) should be used to determine the borrower's share or a corporation's after-tax income and non-cash expenses after obligations that are payable in less than one year have been deducted from the corporate tax returns.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.