Loading

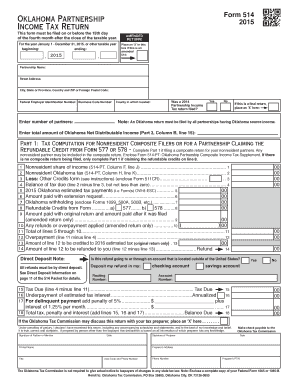

Get Instructions For Completing The Form 514 - Ok

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Instructions For Completing The Form 514 - Ok online

This guide provides comprehensive instructions for filling out the Form 514 online, focusing on user-friendly steps and clarifications for each section and field. Designed for individuals with varying levels of experience, this guide emphasizes accuracy and compliance in tax reporting.

Follow the steps to successfully complete Form 514 online.

- Click the 'Get Form' button to obtain the form and open it in the editor.

- Enter the partnership's name, address, and Federal Employer Identification Number (FEIN) in the corresponding fields.

- Indicate whether this form is an amended return by placing an 'X' in the appropriate box if applicable.

- Complete Part 1 for tax computation related to nonresident composite filers, ensuring that you enclose Form 514-PT if filing for nonresident partners.

- Fill out Part 2 which details ordinary income from trade or business, including gross receipts, deductions, and any other applicable income sources.

- Complete Part 3 to report distributive share items, making sure to follow the instructions for specific lines related to income and deductions.

- If the partnership has operations within and outside of Oklahoma, apportion the income in Part 4 according to the provided formula.

- In Part 5, enter the names and information for each partner, including their distributive share of income and any applicable payments or credits.

- After verifying all entries, save changes to the form. You can then download, print, share, or file the form as required.

Complete your Oklahoma tax documents online to ensure timely and accurate submissions.

Related links form

Single or married filing separately: $6,350. Head of household: $9,350. Married filing jointly or Qualifying widower: $12,700.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.