Loading

Get Nyc 210

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NYC 210 online

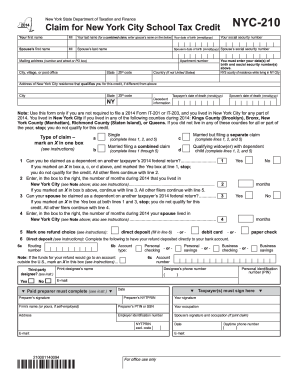

Filing your NYC 210 form online can be straightforward with the right guidance. This document is intended for individuals claiming the New York City School Tax Credit, and it is important to accurately fill out each section to ensure you receive the benefits you qualify for.

Follow the steps to complete your NYC 210 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your first name, middle initial, last name, date of birth (mmddyyyy), and social security number. If you are filing a combined claim, enter your spouse's first name, middle initial, last name, and date of birth in the corresponding fields.

- Fill in the mailing address, including number and street or PO Box, city, state, and ZIP code, along with apartment number if applicable. If you reside outside the United States, indicate your country.

- Indicate your New York State county of residence while living in New York City. If your address for the credit is different from your mailing address, provide the details of your New York City residence.

- Mark the type of claim you are filing by selecting the appropriate box: Single, Married but filing a separate claim, Married filing a combined claim, or Qualifying widow(er) with dependent child.

- Answer the questions regarding dependency status and the number of months you or your spouse lived in New York City during 2014 as instructed.

- Select your preferred refund choice: direct deposit, debit card, or paper check. If choosing direct deposit, complete the required bank account information.

- If applicable, fill out the third-party designee section by providing the designee’s name and phone number.

- Ensure that you and your spouse (if applicable) sign the form where indicated.

- After completing all necessary fields, you can save the changes, download, print, or share the completed form as needed.

Start filling out your NYC 210 form online today to ensure you receive your tax credit.

The NYC School Tax Credit You can take a refundable credit of $125 if you're married, file a joint return, and have income of $250,000 or less. All other taxpayers with incomes of $250,000 or less can receive a refundable credit of up to $63.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.