Loading

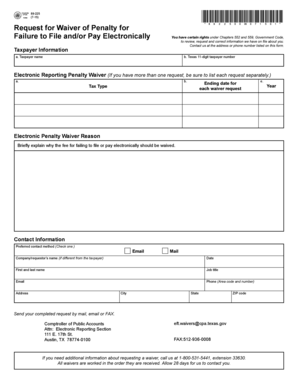

Get 89-225 Request For Waiver Of Penalty For Failure To File Andor Pay Electronically 89-225 Request

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 89-225 Request For Waiver Of Penalty For Failure To File Andor Pay Electronically 89-225 Request online

The 89-225 Request for Waiver of Penalty for Failure to File and/or Pay Electronically is an important document for those seeking relief from penalties. This guide provides clear, step-by-step instructions to help users complete the form accurately and efficiently online.

Follow the steps to complete your waiver request online.

- Use the ‘Get Form’ button to access the 89-225 Request form and open it for editing.

- In the Taxpayer Information section, enter your full name and the 11-digit Texas taxpayer number correctly to identify your account.

- If submitting multiple waiver requests, list each request separately in the Electronic Reporting Penalty Waiver section by specifying the tax type and the ending date for each request.

- In the Electronic Penalty Waiver Reason section, provide a brief and clear explanation of why the penalties should be waived, ensuring your reasoning is understandable.

- Fill out your Contact Information by selecting your preferred contact method, providing your name (if different from the taxpayer), job title, email, phone number, and mailing address.

- After completing the form, review all entered information for accuracy. You can then save changes, download, print, or share the completed form as needed.

Begin the process of filing your 89-225 Request online today.

Related links form

Fires, natural disasters or civil disturbances. Inability to get records. Death, serious illness or unavoidable absence of the taxpayer or immediate family. System issues that delayed a timely electronic filing or payment.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.