Loading

Get Ftb 2924

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ftb 2924 online

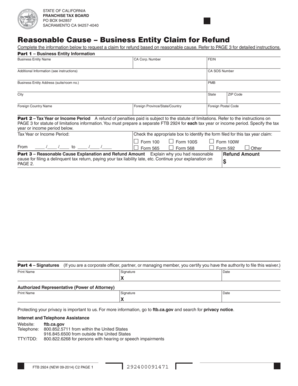

Filling out the Ftb 2924, the reasonable cause claim for refund for business entities, can seem complex. This guide will break down the process into manageable steps, ensuring you can complete the form online with confidence.

Follow the steps to accurately complete your Ftb 2924.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Part 1, enter the business entity information. Include details such as the business entity name, CA Corp. Number, FEIN, and business address. Use the Additional Information field for ‘In-Care-Of’ names or any supplemental details.

- Move to Part 2 to specify the tax year or income period for which you are claiming the refund. Remember, a separate Ftb 2924 must be prepared for each tax year.

- In Part 3, provide a detailed explanation for why you believe you had reasonable cause for filing late or requesting a refund. Clearly state the refund amount you are claiming.

- For Part 4, ensure the form is signed by an authorized representative, providing their printed name, signature, and the date. This confirms authority to file the claim.

- After filling out all sections, review your form for accuracy, save changes, and download or print the document for submission.

Complete your forms online today to ensure timely processing.

The additional $800 annual Franchise Tax and potential gross receipts tax on LLCs make doing business in California a little more expensive than doing business in almost any other state. But the costs to form and maintain your California LLC are deductible on your federal income tax, so you can find some savings!

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.