Loading

Get 2014 Schedule Eic Form 1040a Or 1040 - Irs

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the 2014 Schedule EIC Form 1040A Or 1040 - Irs online

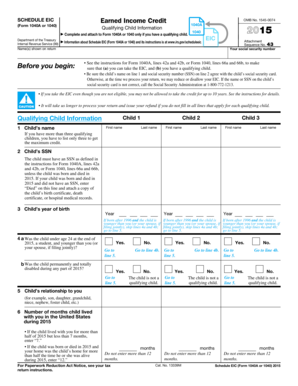

Filing the 2014 Schedule EIC Form 1040A or 1040 is essential for claiming the earned income credit (EIC) if you have qualifying children. This guide will provide step-by-step instructions to help you fill out the form correctly and efficiently online.

Follow the steps to complete your Schedule EIC effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your name(s) as shown on your tax return in the designated section of the form. Ensure that the information matches your tax return to prevent processing delays.

- Enter your social security number in the appropriate field. This must match the number on your tax return.

- Complete the ‘Qualifying Child Information’ section by listing the names of your qualifying children. For each child, provide their first name, last name, and social security number. Ensure that each child's information matches their social security card.

- Indicate the year of birth for each qualifying child in their respective fields. Note the requirements for age and student status if applicable.

- For each child, determine their eligibility by answering the questions regarding their age, student status, and whether they have a permanent disability. Follow the prompts accordingly, ensuring you skip sections if they do not apply.

- Specify each child's relationship to you using the provided options, such as son, daughter, or grandchild.

- Fill in the number of months each child lived with you in the United States during the tax year. Provide accurate details as required, ensuring no more than 12 months is input.

- Review all the information for accuracy and completeness. Ensure that all fields are filled out as applicable to avoid delays in processing your EIC.

- Once all information is verified, save the changes made to your form. You can then download, print, or share the completed form as needed.

Start filling out your documents online today to ensure you take advantage of your earned income credit!

Related links form

If you rented out one of these homes or space in your primary home, you can still report the mortgage interest on a Schedule A so long as you rented the space for fewer than 15 days. If you rented a property for more than 15 days, you must report your rental income and file a Schedule E.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.