Loading

Get Form Et 20

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Et 20 online

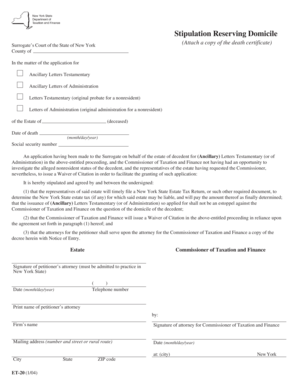

Filling out the Form Et 20 is an essential step for managing the estate of a nonresident decedent in the State of New York. This guide will provide users with clear, step-by-step instructions to successfully complete the form online.

Follow the steps to fill out the Form Et 20 with ease.

- Click ‘Get Form’ button to access the document and open it for editing.

- Enter the decedent's name in the designated field. Ensure it matches the name on the official documents to avoid discrepancies.

- Provide the date of death in the format month/day/year. Accuracy is crucial for legal and administrative purposes.

- Include the decedent's social security number in the specified section. This information is vital for identifying the individual in tax matters.

- In the stipulation section, confirm that you understand the estate tax obligations. Ensure you agree to file the required New York State Estate Tax Return on behalf of the estate.

- Make sure to include the signatures of the petitioner’s attorney and the attorney for the Commissioner of Taxation and Finance as required. Remember that the petitioner's attorney must be admitted to practice in New York State.

- Complete the mailing address and contact information fields. This information is necessary for communication regarding the estate.

- Once all sections are filled out accurately, you can save the changes, download the completed form, print it for physical filing, or share it with relevant parties as needed.

Complete your Form Et 20 online today to ensure a smooth processing of the estate matters.

If the estate generates more than $600 in annual gross income, you are required to file Form 1041, U.S. Income Tax Return for Estates and Trusts. An estate may also need to pay quarterly estimated taxes. See Form 1041 instructions for information on when to file quarterly estimated taxes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.