Loading

Get Direct Deposit Earnings Statement

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Direct Deposit Earnings Statement online

Filling out the Direct Deposit Earnings Statement online is a straightforward process. This guide offers clear instructions to help users navigate each section of the form efficiently.

Follow the steps to complete your Direct Deposit Earnings Statement online.

- Click ‘Get Form’ button to obtain the document and open it for editing.

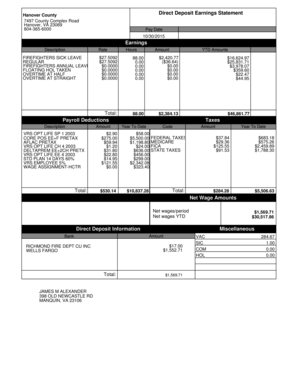

- Review the pay date section to confirm the date is correct. This section typically reflects when your earnings are scheduled to be deposited.

- In the earnings section, input the relevant descriptions, rates, hours worked, and amounts earned for each category listed. Ensure totals align correctly for accuracy.

- Proceed to the payroll deductions area. Fill in the amounts for each deduction type. Double-check that all necessary deductions are included to reflect your net earnings accurately.

- Next, complete the taxes section with the correct amounts according to your withholding statuses, ensuring year-to-date totals are updated accordingly.

- In the net wage amounts area, verify that the net wages for the period and year-to-date are accurately calculated based on your inputs.

- Provide your direct deposit information by entering your bank details and verifying the account numbers for accuracy.

- Finally, review all sections of the form for completeness and accuracy. Once satisfied, you can save your changes, download the form, print it, or share it as needed.

Complete your Direct Deposit Earnings Statement online today for a seamless experience.

Related links form

Normal income verification The normal way for a self employed person to verify their income to a bank for a full doc loan is to provide: The last two years' financial statements (Profit & loss and balance sheet). The last two years' business tax returns. The last two years' personal tax returns.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.