Loading

Get Publication 4491 W Answersxlsx - Irs

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Publication 4491 W Answersxlsx - Irs online

Filling out the Publication 4491 W Answersxlsx - Irs online can be straightforward when you follow a structured approach. This guide will walk you through the essential steps to ensure you complete the form accurately and efficiently.

Follow the steps to complete the Publication 4491 W Answersxlsx - Irs online

- Click the ‘Get Form’ button to retrieve the Publication 4491 W Answersxlsx - Irs and open it in the appropriate editing tool.

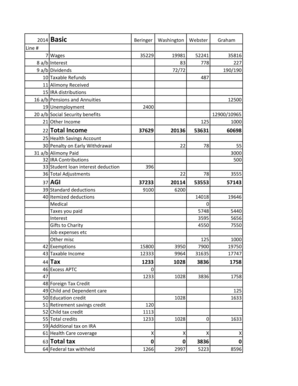

- Begin by entering your basic income information in the designated fields, including wages, interest, and dividends. Ensure each figure is accurate and reflects your income sources.

- Continue to provide adjustments related to your income such as IRA contributions and student loan interest deductions. These adjustments will help calculate your Adjusted Gross Income (AGI).

- Complete the deductions section by selecting either the standard deduction or itemizing your deductions. Include all relevant items like medical expenses, taxes paid, and charitable contributions.

- List any exemptions you are claiming and calculate your taxable income by subtracting deductions from your AGI.

- In the next sections, detail any tax credits you may qualify for, including educational credits or child tax credits, as these can reduce your overall tax liability.

- Finalize your form by reviewing all entered information for accuracy and completeness. Once satisfied, you can save your changes, download, print, or share the completed document.

Start completing your documents online today for a seamless experience.

The five dependency tests – relationship, gross income, support, joint return and citizenship/residency – continue to apply to a qualifying relative. A child who is not a qualifying child might still be a dependent as a qualifying relative.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.