Loading

Get Coefficient Table Wh 134

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Coefficient Table Wh 134 online

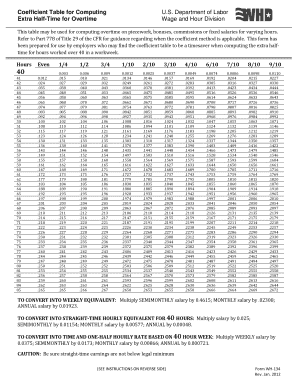

This guide provides comprehensive instructions on filling out the Coefficient Table Wh 134 online, a useful resource for calculating extra half-time wages due to overtime hours. The table simplifies the process for users of varying legal knowledge.

Follow the steps to accurately complete the Coefficient Table Wh 134.

- Press the ‘Get Form’ button to access the Coefficient Table Wh 134 online and open it in the editor.

- Review the table for the hours worked, ranging from 41 to 80 hours. Identify the corresponding coefficient in each row of your working hours.

- If necessary, convert the salary to the appropriate weekly equivalent as outlined in the form. Use the provided multipliers for semi-monthly, monthly, or annual salaries to ensure accuracy.

- Calculate the extra half-time due. Multiply the straight-time earnings by the coefficient corresponding to the total hours worked divided by two.

- Complete additional calculations as necessary for bonuses or varying earnings. Follow the examples provided in the form to apply the current coefficients to any additional payments.

- Once all data has been entered and calculated, review the information for accuracy. Make sure to check that all coefficients align with the correct hours worked.

- Save your changes, and download, print, or share the completed form as needed for your records.

Complete your documents online today to streamline your payroll process.

To calculate coefficient overtime you divide the weekly salary amount by the actual number of hours in given work week. You then establish an effective hourly rate and pay overtime based upon that variable rate per week.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.