Loading

Get Withdrawal Request Form - Path2college 529 Plan

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Withdrawal Request Form - Path2College 529 Plan online

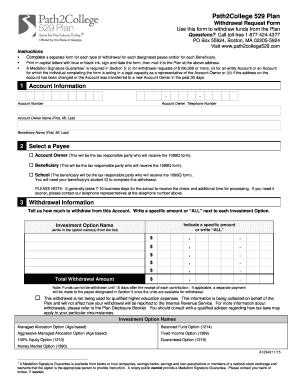

Completing the Withdrawal Request Form for the Path2College 529 Plan can seem daunting, but with this guide, you will have clear, step-by-step instructions to assist you. This process allows you to efficiently withdraw funds from your account to support educational expenses.

Follow the steps to effectively complete your form online.

- Press the ‘Get Form’ button to access the Withdrawal Request Form. Make sure to open the form so you can begin filling it out.

- In Section 1, provide your account information, including the account number, the name of the account owner, their telephone number, and the beneficiary's name. Ensure you fill this out accurately as it identifies your account.

- In Section 3, specify the withdrawal amount. Indicate the desired amount next to each Investment Option listed. You may opt to write ‘ALL’ if you want to withdraw the entire account balance. Be mindful of the 10-day wait period after contributions for withdrawals.

- In Section 4, choose your delivery method by checking the appropriate box. Options include overnight delivery, payment by check, electronic funds transfer, or direct payment to an eligible educational institution. Ensure that you follow any additional requirements for your selected method.

- In Section 5, sign and date the form to authorize the withdrawal. Make sure this section is complete, or your withdrawal request cannot be processed. A Medallion Signature Guarantee may be required based on specific circumstances.

- After reviewing all sections for accuracy, save the form. You may then choose to download, print, or share it as needed. Finally, mail the completed form to the Path2College 529 Plan at the address provided.

Start completing your Withdrawal Request Form online today to ensure timely access to your funds!

The spending bill established a lifetime limit of $10,000 per beneficiary and for each sibling that can be withdrawn from a 529 plan to repay student loans, including federal and most private loans. The money can be used without penalties or tax consequences.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.