Loading

Get - Tax Ny

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the - Tax Ny online

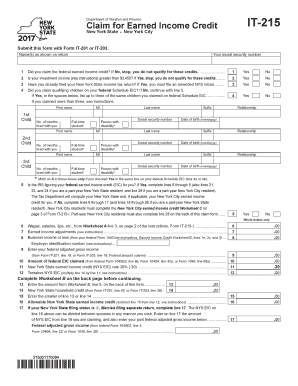

Completing the - Tax Ny form is an important step in claiming your earned income credit in New York. This guide will walk you through each section of the form step-by-step, ensuring you have the necessary information and support to complete the process online.

Follow the steps to successfully complete your - Tax Ny form.

- Press the ‘Get Form’ button to access the document and open it in your preferred editor.

- Provide your name and Social Security number as shown on your tax return. Ensure these details are accurate as they will be essential for processing your form.

- Indicate whether you claimed the federal earned income credit by selecting ‘Yes’ or ‘No’. If you select ‘No’, you do not qualify for these credits, and you may stop here.

- Reply to the investment income question. If your investment income exceeds $3,450, select ‘Yes’, which means you do not qualify for the credits.

- Confirm if you have already filed your New York State income tax return. If you have, you may need to file an amended return.

- If you claimed qualifying children on your federal Schedule EIC, list their names and details on the form. If you have more than three children, refer to the instructions for assistance.

- Indicate whether the IRS is determining your federal earned income credit. Depending on your answer, you will need to complete specific lines on the form.

- Calculate your federal adjusted gross income using Form IT-201 or IT-203. Enter this amount on the appropriate line.

- Fill in the amount of federal earned income credit claimed, as provided in your federal tax forms.

- Follow the directions to compute your New York State earned income credit based on the provided rates and your taxable income.

- If you are a part-year resident, complete the additional sections regarding your New York State earned income credit.

- Review all entries for accuracy. Make any necessary changes and finalize the data.

- Save your changes, download, print, or share the completed form as needed to ensure your application is submitted.

Start filling out your - Tax Ny form online today to claim your earned income credit!

Sales Tax Calculation and Formula Here's how to calculate the sales tax on an item or service: Know the retail price and the sales tax percentage. Divide the sales tax percentage by 100 to get a decimal. Multiply the retail price by the decimal to calculate the sales tax amount.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.