Loading

Get Rc4288

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Rc4288 online

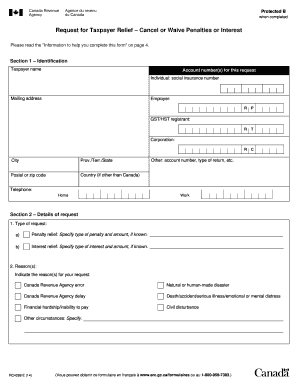

The Rc4288 form is essential for individuals seeking taxpayer relief by canceling or waiving penalties or interest. This guide provides clear, step-by-step instructions to help users navigate the online completion of this important document.

Follow the steps to fill out the Rc4288 form online.

- Press the ‘Get Form’ button to access the Rc4288 form. This will open the document in your online editing tool.

- In Section 1, provide your identification details, including your name, account number, mailing address, and telephone numbers. Ensure that the information is accurate and complete.

- Move to Section 2, where you need to specify the details of your request. Indicate whether you are seeking penalty relief or interest relief and provide details, including the type and amount if known.

- In the same section, state the reason(s) for your request. Choose from the options provided, such as Canada Revenue Agency error or financial hardship, and add any additional relevant details.

- Next, specify the year(s) or period(s) involved in your request. This allows for clarity regarding the tax years or reporting periods that your request pertains to.

- Indicate if this is a request for a second review by answering the appropriate question. If yes, you will be directed to provide further information in relation to your previous submission.

- For information to support your request, describe your circumstances thoroughly. Attach an additional sheet if necessary to ensure you provide a complete narrative.

- If applicable, provide reasons for the second review and attach any new documentation that supports your case.

- In Section 3, include all pertinent supporting documentation that validates your claim for relief. You may need to gather various records to strengthen your request.

- Finally, Section 4 requires certification. If you are represented, provide the representative’s information, along with your signature and date to validate the document.

- Once the Rc4288 form is completed, save your changes and choose to download, print, or share the form as needed.

Start completing your Rc4288 form online to gain taxpayer relief today.

Reload the page to ensure that you see the most recent data. The rate in effect for the quarter commencing April 1, 2023 is 5%. The following table lists yields on Government of Canada Treasury bills for the month of January 2023.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.