Loading

Get Know Before You Owe: Closing Time Initial Escrow Disclosure - Files Consumerfinance

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KNOW BEFORE YOU OWE: CLOSING TIME Initial Escrow Disclosure online

Filling out the Initial Escrow Disclosure is an important step in understanding your mortgage costs. This guide provides clear and supportive instructions to ensure you complete the form correctly and confidently.

Follow the steps to fill out the Initial Escrow Disclosure form accurately.

- Click ‘Get Form’ button to access the Initial Escrow Disclosure form and open it in your preferred online editor.

- Begin by entering your name and contact information at the top of the form. This helps to ensure the document is properly associated with your account.

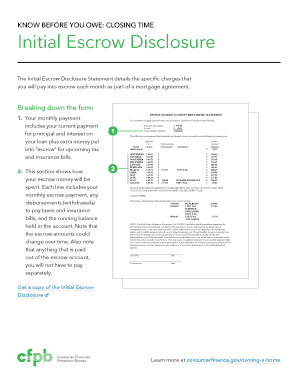

- Provide details regarding your mortgage payment. This includes the principal and interest payments for your loan, as well as the amount you will pay into escrow each month.

- In the escrow section, specify the anticipated charges such as property taxes and insurance premiums. Each of these should include a breakdown of the monthly payment amounts, grouped by category.

- Review the disbursements that will be covered by your escrow payments. This shows how much will be paid out for taxes and insurance, ensuring you know what expenses are being handled through the escrow account.

- Examine the running balance in the escrow account section to understand how these payments will affect your overall balance.

- After completing all required sections, ensure all information is accurate and up to date. Make any necessary edits before finalizing.

- Save your changes, then download, print, or share the form as needed for your records.

Complete your documents online and ensure you understand your escrow commitments.

Your lender is required to send you a Closing Disclosure that you must receive at least three business days before your closing. It's important that you carefully review the Closing Disclosure to make sure that the terms of your loan are what you are expecting.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.