Loading

Get This Form Must Be Typed Or Laser Printed. - Sos Alabama

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the This Form Must Be Typed Or Laser Printed. - Sos Alabama online

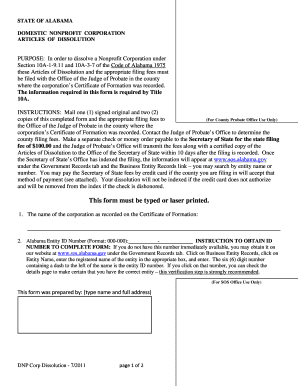

This guide provides detailed instructions on how to properly complete the This Form Must Be Typed Or Laser Printed. - Sos Alabama. Users can follow these steps to ensure that their form is filled out correctly and submitted in accordance with Alabama's requirements for nonprofit corporation dissolution.

Follow the steps to fill out the form accurately.

- Press the ‘Get Form’ button to access the form and open it in your document processing tool.

- Enter the name of the corporation exactly as it appears on the Certificate of Formation.

- Input your Alabama Entity ID Number in the format of 000-000. If you do not have this number, follow the instructions provided to obtain it from the relevant state resources.

- Mention the date when the Statement of Intent to Dissolve was filed at the Office of the Judge of Probate, using the format MM/DD/YYYY.

- Select one of the options regarding the plan of distribution; check 'No plan of distribution was adopted' or attach the distribution plan.

- Certify that all debts and obligations of the corporation have been settled or that adequate provisions have been made.

- Confirm that the remaining assets of the corporation have been distributed in compliance with Title 10A of the Alabama Code.

- State whether there are any pending lawsuits against the corporation and ensure that adequate provision is made for any potential legal obligations.

- Note that the Articles of Dissolution will become effective upon recording by the Office of the Judge of Probate.

- Sign and date the form in the designated signature areas, ensuring that all required signatures are included.

- Once the form is completed, save your changes, download the finalized document, and prepare it for printing.

- Mail the signed original and two copies along with the appropriate filing fees to the Office of the Judge of Probate in your county, ensuring compliance with the payment methods outlined.

Complete your documents online today to efficiently manage your nonprofit corporation's dissolution process.

Related links form

Alabama requires LLCs to file a Business Privilege Tax Return and Annual Report with the Department of Revenue on or before three and one-half months after the beginning of the LLC's taxable year. Taxes. For complete details on state taxes for Alabama LLCs, visit Business Owner's Toolkit or the State of Alabama .

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.