Loading

Get 5013-s1 - T1 General 2014 - Schedule 1 For Non-residents And ... - Cra-arc Gc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

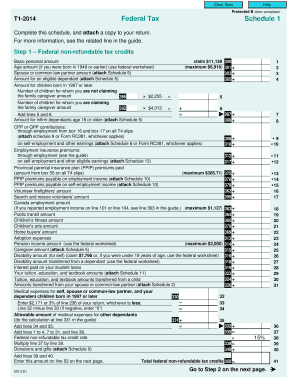

How to fill out the 5013-S1 - T1 General 2014 - Schedule 1 for non-residents online

This guide provides clear instructions on how to complete the 5013-S1 - T1 General 2014 - Schedule 1 for non-residents. By following these steps, you can efficiently fill out the form online, ensuring you meet all necessary requirements.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with Step 1 - Federal non-refundable tax credits. Here, you will claim various tax credits. Start by entering your total contributions to these credits, which may include amounts for medical expenses, childcare, and other eligible expenses listed in the form.

- Include any Employment Insurance premiums through employment, and calculate any required Provincial parental insurance plan premiums as applicable. Ensure to attach the necessary Schedules, such as Schedule 8 for self-employment earnings.

- Proceed to Step 2 - Federal tax on taxable income. Enter your taxable income as indicated on line 260 of your return. Carefully complete the appropriate column based on your income level, ensuring to calculate your federal tax accordingly.

- Move on to Step 3 - Net federal tax. Here, you will add any federal tax credits you may qualify for and complete any required calculations. Ensure to include specific information about any overseas employment tax credits or additional deductions applicable to your situation.

- Review all entered information carefully. Save your changes, and if necessary, download, print, or share the completed form for your records.

Complete your documents online to ensure timely and accurate submission.

If you are a non-resident, you need to file a special tax return – Form 5013-R T1 (Income Tax and Benefit Return for Non-Residents and Deemed Residents of Canada).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.