Loading

Get (nonprofit) (ss-4418)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the (Nonprofit) (SS-4418) online

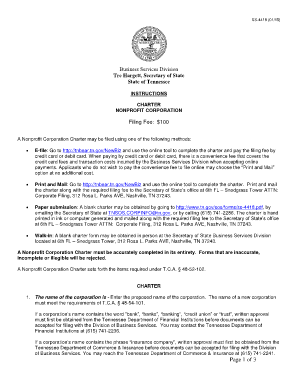

Filling out the (Nonprofit) (SS-4418) form online is an important step in establishing your nonprofit corporation. This guide provides clear and detailed instructions to help users accurately complete the form and ensure a smooth filing process.

Follow the steps to successfully complete the (Nonprofit) (SS-4418) form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the proposed name of the corporation in the first field. Ensure the name complies with the requirements of T.C.A. § 48-54-101.

- If applicable, check the box for Name Consent if you are requesting to use a name indistinguishable from an existing business. An additional $20 filing fee applies.

- If applicable, specify any additional designation of the corporation, like 'Bank' or 'Insurance Company'.

- Provide the name and complete address of the initial registered agent and office in Tennessee. Ensure the address is deliverable by the United States Postal Service.

- Indicate the fiscal year close month. If not specified, December will be listed by default.

- If the corporation has a specified duration, indicate it by checking the appropriate box. If perpetual, check the 'perpetual' box.

- Enter the delayed effective date and time if the corporation's existence is to begin on a future date. The date cannot exceed ninety calendar days from filing.

- Acknowledge the statement that the corporation is not for profit by signing the charter.

- Complete the required sentences by checking the appropriate options regarding the corporation's status as public or mutual benefit, religious affiliation, and membership existence.

- Provide the complete address of the principal executive office.

- If there is a different mailing address, provide it in this section.

- List each incorporator's name and complete address, ensuring the signer is included.

- If applicable, check the box certifying exemption from the filing fee for school organizations.

- Insert any provisions regarding asset distribution upon dissolution of the corporation.

- Use the optional field to include any other relevant information about the corporation.

- Ensure the document is signed and dated by an incorporator listed in Section 11. Type or print the name and title of the signer.

- Review the completed form for accuracy before proceeding to file.

- Save your changes and download or print the form if necessary to share or file as required.

Complete your (Nonprofit) (SS-4418) form online today to ensure your organization is properly established.

Tennessee nonprofit corporations must have at least three board members. We recommend at least seven directors, when possible. Tennessee nonprofit corporations must have o cers, including a president and secretary, who must be different persons.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.