Loading

Get Arizona Form A1-qrt Arizona Quarterly Withholding Tax Return - Azdor

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

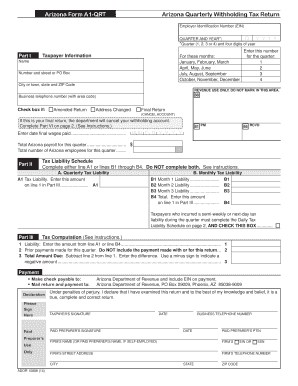

How to fill out the Arizona Form A1-QRT Arizona Quarterly Withholding Tax Return - Azdor online

This guide provides user-friendly instructions for completing the Arizona Form A1-QRT, the Arizona Quarterly Withholding Tax Return. Follow these steps to efficiently file your withholding tax return online, ensuring compliance with Arizona tax regulations.

Follow the steps to fill out the Arizona Form A1-QRT online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your Employer Identification Number (EIN) in the designated field to ensure your business is identified correctly.

- Select the appropriate quarter and year for which you are filing by entering the quarter number (1 to 4) and the four digits of the year.

- Complete the taxpayer information section by providing your name, address, and business telephone number, ensuring accuracy in all fields.

- Indicate if you are filing an amended return, changing your address, or if this is your final return. Check the corresponding box.

- Input the total Arizona payroll for that quarter and the total number of Arizona employees in the respective fields.

- In Part II, choose to complete either the Quarterly Tax Liability line A1 or the Monthly Tax Liability lines B1 through B4, but do not fill out both.

- If applicable, complete the Daily Tax Liability Schedule for any semi-weekly or next-day tax liabilities incurred during the quarter.

- Proceed to Part III to compute your tax amount due. Subtract any prior payments made for this quarter from your tax liability.

- Make the payment by following the given instructions for check or electronic payment, ensuring to include your EIN.

- Review all entries for accuracy, then sign the form and date it as the taxpayer. If a paid preparer has assisted, they must also sign and provide their information.

- Upon completing the form, save your changes, and download or print a copy for your records. Use the online submission method to ensure timely filing.

Complete your Arizona Form A1-QRT online today to ensure compliance with withholding tax regulations.

Effective January 31, 2023, employers must provide Arizona employees with an updated Form A-4, which reflects the State's lower individual income tax rates. Arizona employers are required to make Arizona Form A-4 available to employees at all times and to inform them of Arizona's withholding election options.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.