Loading

Get Uct-115-e, Report Of Business Transfer. This Form Is Used By Employers To Report Business Transfers

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UCT-115-E, Report Of Business Transfer

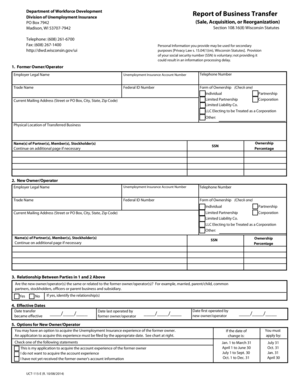

The UCT-115-E, Report Of Business Transfer, is a vital form used by employers to report business transfers, such as sales, acquisitions, or reorganizations. This guide will provide you with detailed, step-by-step instructions to help you navigate and complete the form accurately online.

Follow the steps to fill out the UCT-115-E form effectively.

- Click ‘Get Form’ button to obtain the form and open it in the designated editor.

- Begin with section 1, Former Owner/Operator. Fill out the employer legal name, unemployment insurance account number, telephone number, and trade name. Also, input the federal ID number and select the form of ownership from the given options. Provide the current mailing address and indicate the physical location of the transferred business. List the names of partners, members, or stockholders along with their ownership percentages and social security numbers.

- Move to section 2, New Owner/Operator. Similar to the previous section, input the legal name, unemployment insurance account number, telephone number, trade name, and federal ID number. Choose the form of ownership and provide the current mailing address. Include the names of partners, members, or stockholders, along with their ownership percentages and social security numbers.

- In section 3, indicate the relationship between the former and new owner/operators. Answer 'Yes' or 'No' to whether they are the same or related and, if applicable, identify the relationship.

- Proceed to section 4, Effective Dates. Fill in the date the transfer became effective, the date the former owner/operator last operated, and the date the new owner/operator first operated.

- In section 5, Options for New Owner/Operator, select one of the statements regarding acquiring the unemployment insurance experience of the former owner.

- Section 6 involves indicating the method of transfer. Check the appropriate box for the type of transfer that applies to your situation.

- Section 7, Assets Transferred, is where you need to detail the assets included in the business transfer.

- In section 8, Continuation of Business, answer whether the new owner/operator has continued to operate the same business activity without interruption and in the same location. Provide a new address if applicable.

- For section 9, Number of Employees, indicate how many employees worked in the transferred business prior to the transfer and how many continued with the new owner/operator.

- Section 10, Identify Nature of Business Transferred, requires you to specify the business activity that was transferred.

- In section 11, determine whether this is a total or partial transfer and answer whether the former owner/operator will have payroll or employees after the transfer date.

- Lastly, in section 12, ensure you have the signatures of authorized representatives from both the former and new owners. Include names, positions, signatures, and dates.

- Once all sections are filled out, you can save changes, download, print, or share the form as necessary.

Complete your UCT-115-E form online today to report your business transfer accurately.

If you quit your job for any of the following reasons, you may be eligible to receive UI: Accepting a layoff in lieu of another employee. Quitting with good cause attributable to the employer. Quitting because your health left you with no reasonable alternative but to quit.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.