Loading

Get Do Not File This Return If Philadelphia Wage Tax Was Withheld On All Compensation - Phila

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Do Not File This Return If Philadelphia Wage Tax Was Withheld On All Compensation - Phila online

This guide provides clear instructions on how to accurately complete the Do Not File This Return If Philadelphia Wage Tax Was Withheld On All Compensation - Phila form. By following these steps, users can ensure they fill out the form correctly without hassle.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

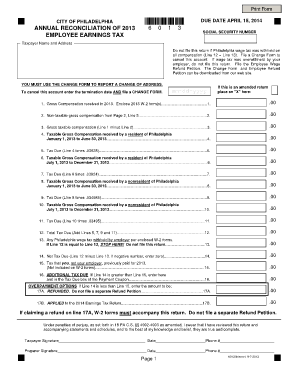

- Begin by entering your social security number in the designated field at the top of the form.

- Provide your taxpayer name and address in the specified sections to ensure accurate identification.

- If applicable, check the box to indicate that this is an amended return.

- Enter the gross compensation you received in 2013. Make sure to attach your 2013 W-2 form(s) as required.

- Report any non-taxable gross compensation from the second page in the appropriate section.

- Calculate your gross taxable compensation by subtracting non-taxable gross compensation from the total gross compensation.

- List the taxable gross compensation you earned as a resident of Philadelphia for the first half of 2013 and compute the tax due using the given rate.

- Repeat the process for the second half of 2013 and for any taxable figures if you are a nonresident.

- Sum up all tax due amounts to arrive at the total tax due, and provide any withheld Philadelphia wage tax as per your W-2 forms.

- Determine your net tax due and provide any tax previously paid that is not reflected on your W-2 forms.

- Decide on your overpayment options if applicable, indicating any amounts you wish to be refunded or applied to your next return.

- Complete the signature section, ensuring that both taxpayer and preparer signatures are provided if applicable.

- Finally, save your changes, then download, print, or share the completed form as necessary.

Complete your documents online to ensure a smooth and efficient filing process.

Overview of Pennsylvania Taxes Pennsylvania has a flat state income tax rate of 3.07%. This is the lowest rate among the handful states that utilize flat rates. However, many cities in the Keystone State also collect local income taxes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.