Loading

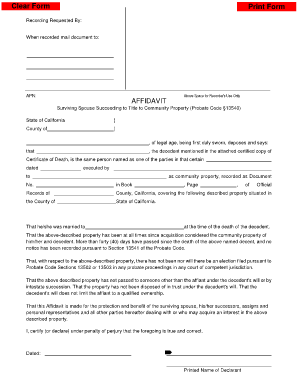

Get Affidavit Of Surviving Spouse California

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Affidavit Of Surviving Spouse California online

This guide provides a clear and supportive overview of how to complete the Affidavit Of Surviving Spouse in California online. By following these steps, users can ensure that their form is filled out accurately and submitted correctly.

Follow the steps to complete your affidavit online.

- Press the ‘Get Form’ button to access the Affidavit Of Surviving Spouse California form. This will open the form in an editable format, allowing you to begin filling it out.

- In the top section, enter the name of the county where the affidavit will be filed, followed by the name of the person swearing the affidavit. Ensure that all fields are filled out in accordance with the instructions.

- List the decedent's name as found on the attached certified copy of the Certificate of Death. Make sure this matches precisely with the official document.

- Fill in the date on which the document was executed. This is the date when the affidavit was signed.

- Enter the names of the parties involved in the community property agreement, as well as the document recording number and the book page in which the agreement is recorded.

- Complete the description of the property located in the county of California. Be specific to avoid any ambiguity.

- Indicate the spouse's name at the time of the decedent's passing. This verifies the marital status at the time of death.

- Confirm that the property has been considered community property since its acquisition and that more than forty days have passed since the decedent's death.

- State that no notice has been recorded in accordance with Section 13541 of the Probate Code, indicating no objections have been made.

- Affirm that there have been no elections filed in probate proceedings regarding the described property. This assures that the affidavit is the sole claim to the property.

- Conclude by stating that the property has not been assigned to someone else under the decedent's will or through intestate succession.

- Finally, sign and date the affidavit, and print your name clearly in the designated area.

- After reviewing all entered information for accuracy, save the document, then proceed to download, print, or share the completed form as necessary.

Start completing your legal documents online today!

Who Gets What in California? If you die with:here's what happens:children but no spousechildren inherit everythingspouse but no children, parents, siblings, or nieces or nephewsspouse inherits everythingparents but no children, spouse, or siblingsparents inherit everything7 more rows

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.