Loading

Get Nh Mileage Reimbursement Rate 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nh Mileage Reimbursement Rate 2020 online

The Nh Mileage Reimbursement Rate 2020 form is essential for individuals seeking reimbursement for transportation expenses related to Workers’ Compensation. This guide provides clear, step-by-step instructions to help you fill out the form accurately online.

Follow the steps to complete the reimbursement form with ease.

- Press the ‘Get Form’ button to access the reimbursement form and open it in the editing interface.

- Review the first section of the form, where you will typically enter your personal and contact information. Ensure that all details are correct and up to date.

- In the next section, you will need to specify the purpose of the travel for reimbursement. Clearly describe the reason for your travel related to Workers’ Compensation.

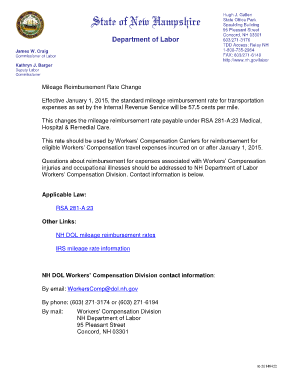

- Fill in the mileage section by entering the total number of miles traveled. Be sure to use the mileage reimbursement rate set at 57.5 cents per mile, effective from January 1, 2015.

- Provide any additional details required, such as dates of travel and starting/ending locations, to substantiate your reimbursement request.

- Review all entries for accuracy and completeness. It is crucial to ensure that all information is correct before submitting your form.

- Finally, you can save your changes, download a copy, print the form, or share it as needed for submission.

Complete your Nh Mileage Reimbursement Rate 2020 form online today for a smooth reimbursement process.

57.5 cents per mile for business miles (58 cents in 2019) 17 cents per mile driven for medical or moving purposes (20 cents in 2019)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.