Loading

Get Mo 941

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO 941 online

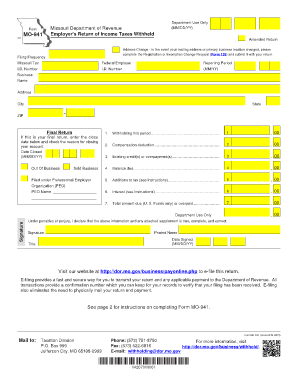

Filing the MO 941 is essential for employers in Missouri to report income taxes withheld from employees. This guide provides you with a clear and user-friendly approach to completing the form online, ensuring that you meet all necessary requirements efficiently.

Follow the steps to complete the MO 941 online

- Click ‘Get Form’ button to access the MO 941 online and open it in your preferred document editor.

- Fill in your Missouri Tax I.D. Number, which is an eight-digit identifier provided by the Missouri Department of Revenue. If needed, register for a new number on their website.

- Specify the reporting period for which you are filing the return, based on your assigned filing frequency.

- For Line 1, enter the total amount of state withholding tax withheld for the reporting period. If there was no withholding during the period, enter zero.

- For Line 3, if you have any existing credits or overpayments, enter the amount to apply towards this reporting period.

- For Line 5, indicate any additions to tax, particularly for failure to pay on time or failure to file by the due date.

- Finally, on Line 7, sum Lines 4, 5, and 6 to determine the total amount due or overpaid. An overpayment will show as a negative figure.

- Review all entries for accuracy and completeness. Once satisfied, save your changes, download a copy for your records, and print if necessary.

Complete your MO 941 online today to ensure timely and accurate filing.

MO-941 - Employer's Return of Income Taxes Withheld.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.