Loading

Get At1 Schedule 9 - Alberta Treasury Board And Finance - Finance Alberta

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AT1 Schedule 9 - Alberta Treasury Board and Finance - Finance Alberta online

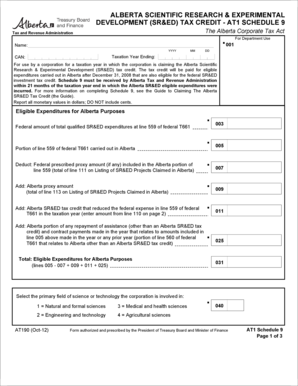

Filling out the AT1 Schedule 9 can seem daunting, but with the right guidance, you can complete this form efficiently. This guide provides clear, step-by-step instructions to help you navigate the components of the form and ensure that you correctly report your eligible expenditures for the Alberta Scientific Research & Experimental Development tax credit.

Follow the steps to successfully complete the AT1 Schedule 9 online.

- Use the ‘Get Form’ button to access the form and open it in the designated editor.

- Enter your corporation's name and the taxation year ending in the designated fields. Ensure the date format is YYYY-MM-DD.

- Report all monetary values in dollars and avoid using cents. Start by inputting the federal total qualified SR&ED expenditures from line 559 of federal T661 in the appropriate section.

- Next, indicate the portion of the federal amount that was conducted in Alberta. This will reflect the eligible expenditures for Alberta purposes.

- If applicable, input the federal prescribed proxy amount that is included in your Alberta portion. Follow this by entering the Alberta proxy amount derived from your Listing of SR&ED Projects Claimed in Alberta.

- Add the Alberta SR&ED tax credit that impacted the federal expenses, captured from line 110 on page 2, along with any repayment assistance related to the expenditures.

- Select the primary field of science or technology that applies to your corporation's activities by choosing the appropriate number from the provided options.

- Determine whether your corporation is associated with others for SR&ED purposes. If 'Yes', complete the additional pages as required. If 'No', calculate the maximum expenditure limit by following the given formula.

- Calculate the Alberta SR&ED tax credit by taking the lesser of the values submitted and applying the 10% calculation.

- Complete any additional required sections, including recapture amounts if applicable, and ensure that you fill in any amounts necessary from supplementary schedules.

- After filling in all relevant sections, save your changes. You can also choose to download, print, or share the completed form as needed.

Begin completing the AT1 Schedule 9 form online to ensure timely submission and take advantage of your eligible tax credits.

The Alberta Agri-Processing Investment Tax Credit will give a 12 per cent non-refundable tax credit to corporations that make a minimum capital investment of $10 million or more to to build or expand agri-processing facilities in Alberta.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.