Loading

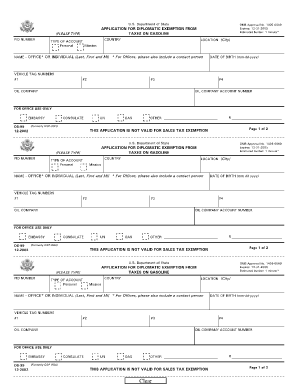

Get Application For Diplomatic Exemption From - State

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the APPLICATION FOR DIPLOMATIC EXEMPTION FROM - State online

Filling out the Application for Diplomatic Exemption from Taxes on Gasoline is essential for eligible individuals or offices to claim their exemptions. This guide provides straightforward instructions tailored to assist users in completing the application accurately and efficiently.

Follow the steps to successfully complete your application.

- Click ‘Get Form’ button to obtain the form and open it in your preferred document editor.

- In the 'PID Number' field, enter your personal identification number if applicable. This is important for processing your application.

- Next, specify the country for which you are applying the exemption. Ensure that the name of the country is accurately spelled to avoid potential errors.

- Select the type of account from the available options: Personal or Mission. This indicates whether the application is for individual use or on behalf of a diplomatic mission.

- In the 'Location (City)' field, provide the city where the exemption is applicable. Be specific to ensure proper processing.

- For the 'Name - Office or Individual' field, enter your last name followed by your first name and middle initial (if applicable). If this application is for an office, also include the contact person's name.

- Fill in your date of birth in the specified format (mm-dd-yyyy) to verify your account details.

- List the vehicle tag numbers in the spaces provided (#1, #2, and #3) as required for identification of the vehicles under the exemption.

- Indicate the name of the oil company you will be using and provide the oil company account number in the designated field.

- After reviewing all the information entered, you may choose to save your changes, download, print the form, or share it as necessary.

Complete your documents online to ensure a smooth submission process.

When you file exempt with your employer for federal tax withholding, you do not make any tax payments during the year. ... When you sit down to do your taxes, if the taxes you owe are less than the total amount withheld, the IRS will send you a tax refund for the difference.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.