Loading

Get - Uitax Ri

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the - Uitax Ri online

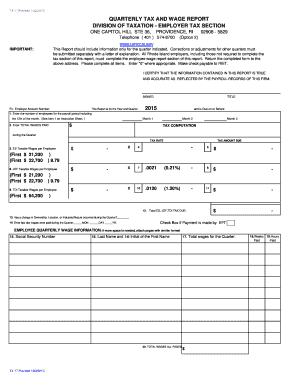

Filling out the - Uitax Ri form is a crucial task for employers in Rhode Island to report wages and taxes accurately. This guide will provide you with clear and concise instructions to navigate each section of the form with ease.

Follow the steps to successfully complete your - Uitax Ri form.

- Press the ‘Get Form’ button to access the - Uitax Ri document, allowing you to begin filling it out in your preferred format.

- Identify the year and quarter for which you are reporting. Ensure that you have the correct dates, as this report should reflect information only for the specified period.

- In the section labeled 'Number of employees for the payroll period,’ input the total number of employees who were active during the payroll that includes the twelfth of the month. If there were none, please enter '0'.

- Enter the total wages paid during the quarter for each month, ensuring that you account for all forms of compensation, including wages, meals, and lodging.

- For tax computation, fill in the taxable wages per employee for Employment Security, Job Development Fund, and Temporary Disability Insurance. Ensure you follow the specified wage caps for accurate tax calculation.

- Total the Employment Security, Job Development Fund, and Temporary Disability Insurance taxes due, ensuring that all calculations are accurate.

- If there was a change in ownership, location, or industrial nature during the quarter, indicate this in the provided section with a brief explanation if applicable.

- Report the last date wages were paid during the quarter appropriately.

- Complete the employee quarterly wage information section, filling out each line for every employee paid during the quarter, including their Social Security number, name, total wages, weeks, and hours paid.

- Review all information for accuracy, ensuring the form is signed by an authorized individual from your firm.

- Once completed, save your changes. You may download, print, or share the form as necessary.

Complete your - Uitax Ri form online to meet your tax reporting requirements efficiently.

Permanent total disability benefits (PTD) are paid to injured workers who will never return to any type of employment. These benefits are paid at 75% of the worker's average weekly wage (AWW) and may continue as long as the person remains totally disabled.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.