Loading

Get Form 39r - Tax Idaho

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 39R - Tax Idaho online

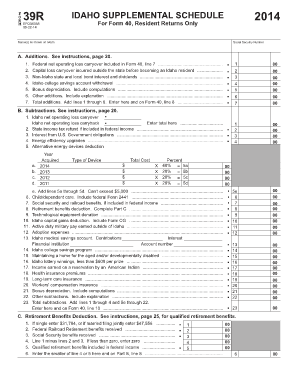

Form 39R is an essential document for Idaho residents filing their taxes. This guide provides clear instructions on how to navigate this form online and enter the necessary information efficiently.

Follow the steps to complete your Form 39R online.

- Press the ‘Get Form’ button to download the form and open it for editing.

- Enter the name(s) as shown on the tax return in the designated field.

- Fill in your Social Security Number accurately in the provided space.

- Complete Section A: Additions by listing each item in the specified lines, including federal net operating loss carryover and other applicable additions.

- Proceed to Section B: Subtractions, entering each category of qualified deductions, such as Idaho net operating loss carryover and other relevant subtractions.

- If applicable, complete Section C related to Retirement Benefits Deductions by providing the necessary details and calculations.

- Fill out Section D for Credit for Income Tax Paid to Other States, making sure to follow the instructions for correct calculations.

- Enter the amounts for credits in Section E, including any contributions to designated Idaho entities.

- Complete Section F regarding maintaining a home for qualifying family members, ensuring to provide accurate information about support.

- If there are any dependents, fill in Section G with the required details as outlined.

- Once all sections are completed, review your entries for accuracy. You can then choose to save your changes, download, print, or share the completed form as needed.

Get started on your Form 39R online today to ensure a smooth filing process.

An Idaho tax power of attorney, or “Form bL375E,” is a designation that allows someone else to be able to handle a citizen's tax filing with the Idaho State Tax Commission. The taxpayer can use the fields to define the exact tax matters for which the agent will be approved to represent them.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.