Loading

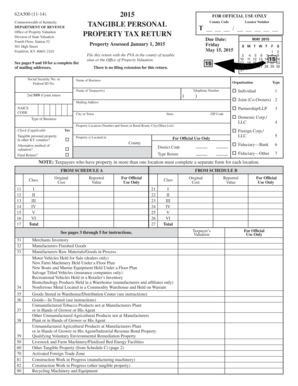

Get 2015 Tangible Personal Property Tax Return 62a500 (11-14) Commonwealth Of Kentucky Department Of

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2015 tangible personal property tax return 62A500 (11-14) Commonwealth of Kentucky online

Filing the 2015 tangible personal property tax return can seem daunting, but with clear guidance, you can confidently complete it online. This comprehensive guide will walk you through each section of the form to ensure your submission is accurate and timely.

Follow the steps to successfully complete the tax return form.

- Click 'Get Form' button to obtain the form and open it for editing.

- Fill in your name or the name of your business where indicated on the form. Ensure that you select the appropriate tax category, such as individual, partnership, or corporation.

- Provide your social security number or federal ID number, along with your telephone number and accurate mailing address.

- Specify the property location by entering the street address and city, ensuring compliance with local regulations.

- Check any applicable boxes regarding tangible personal property in other Kentucky counties, alternative methods of valuation, and whether this is a final return.

- Complete Schedule A by detailing the classes of property you are reporting, including the original cost and reported value by utilizing the correct depreciation factors for the year 2015.

- Fill out Schedule B for manufacturing assets in the same manner as Schedule A, ensuring you adhere to the classification and valuation instructions provided.

- If applicable, complete Schedule C for any other tangible personal property not listed elsewhere, and provide descriptions and values.

- Review your entries for accuracy to avoid mistakes that could lead to penalties.

- Once all fields are accurately filled, you can save your changes. Depending on your needs, download, print, or share the completed form before submitting.

Take action now by completing your tangible personal property tax return online.

In comparison to intangible personal property, tangible property can be touched. Consider property such as furniture, machinery, cell phones, computers, and collectibles which can be felt compared to intangibles such as patents, copyrights, and non-compete agreements that cannot be seen or touched.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.