Loading

Get Application.doc. 2014 Amended Corporation Business Tax Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Application.doc. 2014 Amended Corporation Business Tax Return online

This guide provides a comprehensive overview of how to complete the Application.doc. 2014 Amended Corporation Business Tax Return online. It is designed to assist users navigating the process with clarity and ease.

Follow the steps to successfully complete your application online.

- Press the ‘Get Form’ button to access the document and open it in your editor.

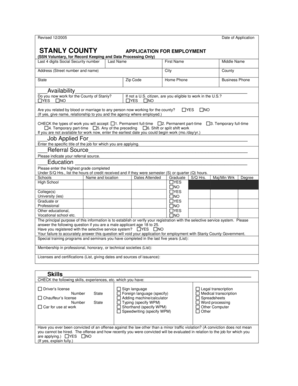

- Begin by entering the date of application in the designated space. This helps track when your application was submitted.

- Provide your last name, first name, and middle name in the corresponding fields to ensure proper identification.

- Fill in your address, including the street number, city, county, state, and zip code, to specify your residence.

- Enter your home and business phone numbers for contact purposes.

- Indicate your availability and willingness to accept various types of employment by checking the appropriate boxes.

- Specify the job title you are applying for in the job applied for section.

- Note your referral source to help the employer identify how you learned about the job opportunity.

- In the education section, list the highest level of education completed along with relevant details about your educational history, including degrees received.

- Fill out the skills section by checking all applicable skills you possess, such as certifications and licenses.

- Provide your work history, including details about previous employers, job titles, and responsibilities.

- List personal references by including their names, phone numbers, relationships, and addresses.

- Complete the equal opportunity information section, keeping in mind that this is voluntary and used for recruitment analysis.

- Certify the information provided by signing and dating the application, ensuring that all details are accurate and truthful.

- Finally, review your completed document, then save, download, print, or share the form as required.

Take the next step towards completing your application online.

Note: Corporate amended returns with carryback claims, may be e-filed as long as the carryback claim box is checked.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.