Loading

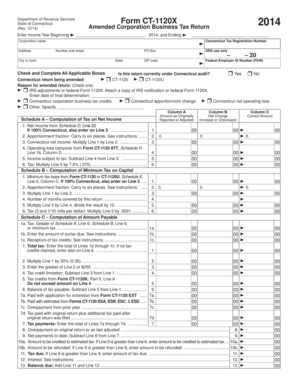

Get Ct-1120x, 2014 Amended Corporation Business Tax Return - Ct

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT-1120X, 2014 Amended Corporation Business Tax Return - Ct online

Filing tax returns can be a complex process, especially when it comes to amendments. This guide will provide you with clear and detailed instructions on how to complete the CT-1120X, the amended corporation business tax return for the year 2014, online.

Follow the steps to properly complete the CT-1120X form.

- Click ‘Get Form’ button to obtain the CT-1120X form and open it for editing.

- Enter the income year details. Fill in the beginning and ending dates for the income year using the provided lines.

- Input the corporation's name, address, and Connecticut tax registration number in the specified fields.

- Indicate whether the return is currently under audit by checking the appropriate box.

- Select the type of return being amended (either CT-1120 or CT-1120U) and reason for amendment by checking the corresponding boxes.

- Complete Schedule A by calculating the net income, apportionment fraction, Connecticut net income, operating loss carryover, and the tax amount. Ensure to enter each computed value in the correct section.

- Proceed to Schedule B to compute the minimum tax based on the corporate business tax calculations. Follow the prompts to determine the minimum tax due.

- Fill out Schedule C for the total tax calculations, including any surtax due and recapture of tax credits.

- Complete Schedule D by entering details related to your federal taxable income and any adjustments that may apply.

- Review all entries for accuracy. Make sure to explain any changes in the space provided and attach necessary additional schedules if required.

- Once all information is completed, save your changes, and choose to download, print, or share the completed form as needed.

Complete your CT-1120X form online today to ensure timely and accurate filing.

File Form CT-1040 EXT on or before April 15, 2023. If your taxable year is other than the calendar year, file Form CT-1040 EXT on or before the fifteenth day of the fourth month following the close of your taxable year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.