Loading

Get Form Ct-1040tcs - Ct

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form CT-1040TCS - Ct online

Filling out the Form CT-1040TCS can seem overwhelming, but with step-by-step guidance, you can complete it confidently. This guide will walk you through the necessary components and fields of the form, offering clarity and support for a successful submission.

Follow the steps to fill out the Form CT-1040TCS online.

- Press the ‘Get Form’ button to acquire the form and open it in your editor.

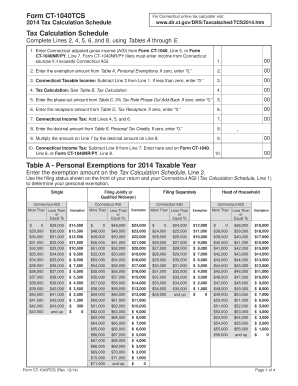

- Begin with Line 1 by entering your Connecticut adjusted gross income (AGI) from Form CT-1040, Line 5, or Form CT-1040NR/PY, Line 7. If applicable, ensure that Connecticut source income is included if it exceeds Connecticut AGI.

- For Line 2, refer to Table A to determine your personal exemption amount based on your filing status. If there are no exemptions to claim, enter '0'.

- Calculate your Connecticut taxable income for Line 3 by subtracting Line 2 from Line 1. If the result is less than zero, write '0'.

- Line 4 requires you to calculate your tax using the rates provided in Table B based on your taxable income from Line 3.

- Refer to Table C to determine the phase-out amount to be entered on Line 5. If there are no amounts for phase-out, input '0'.

- For Line 6, consult Table D to find the recapture amount based on your situation. If none apply, enter '0'.

- Add Lines 4, 5, and 6 to find your total Connecticut income tax for Line 7.

- On Line 8, enter the decimal amount from Table E for your personal tax credits. If no credits are applicable, write '0'.

- Multiply the total from Line 7 by the decimal in Line 8 and write the result on Line 9.

- Finally, subtract the value on Line 9 from the amount in Line 7, entering the result on Line 10. This is your final Connecticut income tax to report.

Begin filling out your Form CT-1040TCS online today!

Program Description State law provides a property tax credit program for Connecticut owners in residence of real property, who are elderly (65 and over) or totally disabled, and whose annual incomes do not exceed certain limits.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.