Loading

Get Short Term Loan Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Short Term Loan Form online

Filling out the Short Term Loan Form online is a straightforward process designed to assist users in securing necessary equipment. This guide offers detailed instructions to ensure a smooth completion of the form, catering to individuals with varying levels of experience in digital document management.

Follow the steps to successfully complete the Short Term Loan Form.

- Click ‘Get Form’ button to obtain the form and open it in your preferred digital platform.

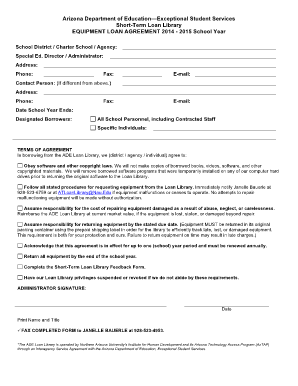

- Begin filling out the initial section by providing accurate information about the school district, charter school, or agency. Ensure that you include the name of the Special Education Director or Administrator along with their contact details such as address, phone number, fax number, and email.

- If the contact person differs from the Administrator, provide their information in the designated fields including their address, phone number, fax number, and email address.

- Input the date when the school year ends to clarify the duration of the equipment loan. This is critical to align with the terms of the agreement.

- Identify designated borrowers, which might include all school personnel as well as any specific individuals authorized to borrow equipment. This ensures accountability and proper asset management.

- Review the terms of the agreement thoroughly. Ensure that you understand the responsibilities regarding the equipment, borrowing guidelines, and repercussions for late or damaged items.

- Once all fields are filled out, review your entries for accuracy. It is beneficial to have someone else verify the information to avoid errors.

- When you are satisfied with the completed form, the final step is to save your changes, download the document, and print it if necessary. Make sure to fax the completed form to Janelle Bauerle at 928-523-4953.

Complete your documents online to ensure prompt and effective management of your equipment loans.

Loan agreements typically include covenants, value of collateral involved, guarantees, interest rate terms and the duration over which it must be repaid. Default terms should be clearly detailed to avoid confusion or potential legal court action.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.