Loading

Get Interest Rate Lock/float Agreement - Dfcs Oregon

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the INTEREST RATE LOCK/FLOAT AGREEMENT - Dfcs Oregon online

Filling out the INTEREST RATE LOCK/FLOAT AGREEMENT is an important step in managing your mortgage loan. This guide will provide clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to successfully complete the form online.

- Click the ‘Get Form’ button to access the form and open it in your preferred online editor.

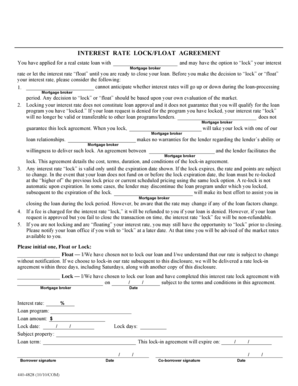

- Begin by entering the name of the mortgage broker you are working with at the top of the form. Ensure the spelling is correct to avoid any misunderstandings regarding your loan agreement.

- Next, select whether you wish to 'lock' your interest rate or let it 'float'. Initial the appropriate section to indicate your choice. If you choose to float, be aware that your rate may change at any time without prior notification.

- Fill in the relevant details such as the interest rate you wish to lock in, the loan amount, the subject property, and the loan term. Use clear and correct numeric entries for these fields.

- Enter the lock date and the expiration date for the lock-in agreement. This information is crucial as it determines the validity of your rate lock.

- Review the terms and conditions of your interest rate lock agreement carefully. Take note of any fees associated with locking your rate, including the conditions under which these fees may be refunded.

- After reviewing, ensure to sign the agreement at the designated spots for the borrower and co-borrower, if applicable. Make sure to also date the signatures.

- Finally, ensure all sections are complete and review the information you've entered. Save changes, download the completed form, and print or share it as necessary.

Take control of your mortgage process—complete your documents online today.

The term mortgage rate lock float down refers to a financing option that locks in the interest rate on a mortgage with the option to reduce it if market rates fall during the lock period. A typical rate lock provides a borrower with security against an increase during the rate lock period.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.