Loading

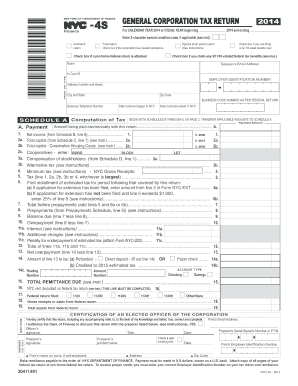

Get Minimum Tax (see Instructions) - Nyc Gross Receipts

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Minimum Tax (see Instructions) - NYC Gross Receipts online

Filling out the Minimum Tax form for NYC Gross Receipts can appear daunting, but with clear guidance, you can navigate the process with confidence. This comprehensive guide will walk you through each section of the form, providing you with the necessary steps to ensure accuracy and compliance.

Follow the steps to successfully complete your NYC Gross Receipts Minimum Tax form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with entering your corporation's name and Employer Identification Number (EIN) in the appropriate fields. Ensure all information is accurate to avoid any processing issues.

- Fill in your business address, including the city, state, and zip code. This information is crucial for the proper identification of your corporation.

- Indicate the start date of your business operations in NYC. If applicable, you can also state if this is your final return, whether you are filing for a 52-53 week taxable year, or claiming any federal tax benefits related to 9/11.

- Complete Schedule A, which includes computations for tax liabilities. Enter your net income, total capital, or minimum tax, ensuring you follow the instructions provided for accurate calculations.

- If applicable, report on the compensation of stockholders in Schedule D, providing details such as names and compensation amounts. This section requires transparency regarding the distribution of financial resources within your corporation.

- Review all sections for accuracy and ensure that you have completed Schedule B and Schedule E as necessary, particularly focusing on NYC taxable net income and key business details.

- Upon finalizing all fields, review your entries one last time for completeness and accuracy. Be attentive to any necessary attachments, such as your federal return.

- Once you have confirmed that all information is complete and verified, proceed to save your changes, download or print the completed form for your records, or share it as needed.

Complete your NYC Gross Receipts Minimum Tax form online today to ensure your compliance and avoid any penalties.

You have to file a federal return. You did not have to file a federal return but your federal adjusted gross income plus New York additions was more than $4,000 ($3,100 if you are single and can be claimed as a dependent on another taxpayer's federal return).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.